oregon tax payment deadline

March 15 2022 Deadline for partnership tax returns and LLCs that are taxed as a partnership as well as S-corporation tax returns. If the due date falls on a Saturday Sunday or legal.

The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020.

. Oregon Department of Revenue. Estimated tax payments for tax year 2020 are not extended. The February 1st deadline to make the 4th quarter payment for the Oregon Corporate Activity Tax CAT is coming up on us quickly.

The Oregon Department of Revenue DOR intends to follow guidance from the IRS when more details become available. Accordingly the first CAT payment is due April 30 2020. The IRS and Oregon changed the tax filing and payment deadline from April 15 to May 17.

The Oregon Department of. Free tax preparation services Learn more. Payment of estimated tax.

Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed. Choose to pay directly from your bank account or by credit card. Jun 15 2nd quarter payment due for filers with a calendarDecember year end.

Oregon has not extended the due date of the first payment for its new Corporate Activity Tax CAT. Estimated payments are not required. This automatic Oregon tax filing and payment deadlines extension incorporates some but not all of the elements of the federal income tax filing and payment deadlines extension.

503 945-8199 or 877 222-2346. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021. The Oregon Department of Revenue has announced that the state of Oregon will automatically extend the tax filing and payment deadline for individual taxpayers to May 17 2021.

Oregon Department of Revenue. Any business concern that has substantial nexus with Oregon regardless of legal entity. Form OR-40 OR-40-N and.

By phone with credit debit or prepaid card American Express not accepted. Calendar year filers. 2022 second quarter individual estimated tax payments.

The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. The Oregon tax filing and tax payment deadline is April 18 2022. Jun 15 4th quarter payment due for filers with a June fiscal year end.

Jun 15 3rd quarter payment due for filers with a September fiscal year end. April 15 2022 Deadline for 2022 Q1 estimated tax payments. 2022 third quarter individual estimated tax payments.

2021 individual income tax returns filed on extension. Everything you need to file and pay your Oregon taxes. Monday through Friday from 800 am.

Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. Find IRS or Federal Tax Return deadline details. During Wednesday mornings conference call with the media Governor Kate Brown said personal filing deadlines will be extended until July 15.

We will continue to monitor the situation closely. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020. Payment due dates Estimated tax payments are due quarterly as follows.

Oregon will honor the federal automatic extension to October 15 2021. Instructions for personal income and business tax tax forms payment options and tax account look up. Both the IRS and the Oregon Department of Revenue will be providing formal guidance in the coming days.

What are the specific Oregon tax returns for which filing deadlines have been extended to May 17 2021. Months in the short tax year. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July 15 2020.

If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers. Skip to the main content of the page. Mail a check or money order to.

Extension of time to file. Filing and payment deadlines Returns and tax payments for the 2021 calendar year are due by March 15 2022. If you have any questions the tax office is open during regular business hours.

Fiscal year returns are due by the 15th day of the third month after the end of the partnerships tax year. Taxpayers subject to the CAT. April 15 June 15 September 15 and December 15.

Oregon Corporate Activity Tax payment deadline remains April 30. Taxpayers who have filed their 2020 Oregon tax returns and owe unpaid taxes should pay the tax due by May 17 2021. When are 2020 taxes due.

Jun 15 1st quarter payment due for filers with a February fiscal year end. Find approved tax preparation services. Otherwise penalty and interest will begin to be charged after May 17 2021 for any amount remaining unpaid.

January 31 2022 Deadline for your employees and independent contractors to receive their W-2 or 1099-NEC1099-MISC forms. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. April 15 July 31 October 31 January 31.

The due dates for estimated payments are. However an extension to file is not an extension to pay. To review for the 2020 tax year if you expect a Corporate Activity Tax liability of 10000 or more then you are required to make estimated quarterly payments.

Fiscal year filers. The 15th day of the 4th 6th 9th and 12th months of your fiscal year.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

List Of State Income Tax Deadlines For 2022 Cpa Practice Advisor

Oregon State Tax Updates Withum

The Tax Deadline Is May 17 Make These Moves Before You File Forbes Advisor

How To File Your Taxes In Portland Oregon Cccu

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Where S My Oregon State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

E File Oregon Taxes For A Fast Tax Refund E File Com

Understanding Your Property Tax Bill Clackamas County

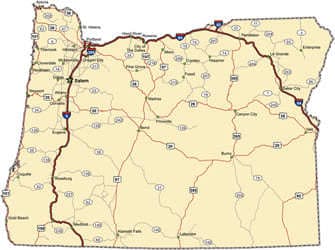

Oregon Ifta Fuel Tax Requirements

Tax Day Irs Pushes 2020 Tax Filing And Payment Due Date From April 15 2021 To May 17 2021 Abc7 San Francisco

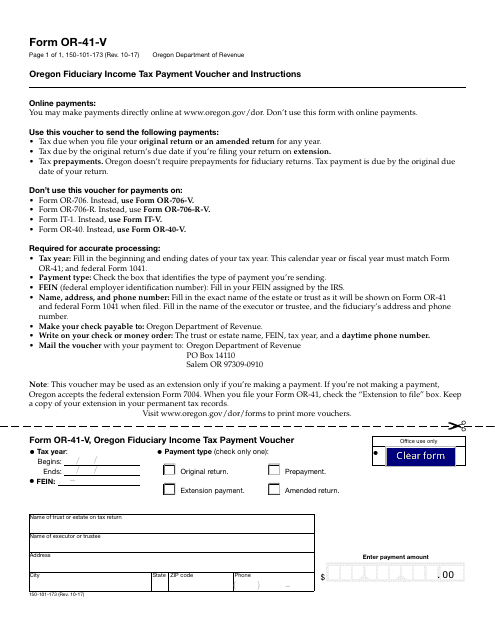

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller